The migration to generic hardware and network functions virtualization (NFV) is putting a strain on current video equipment prices, according to a recent report.

Overall, global broadcast and streaming video equipment revenue decreased 4 percent to $810 million in the first half of 2014 with nearly all product segments down, according to a report by Infonetics Research. The report tracked the pay-TV video equipment sold to cable, telco IPV and satellite TV providers.

“The cost of encoding and transcoding platforms continues to come down, pressuring video and broadcast equipment revenue as pay-TV providers move to generic hardware platforms and, ultimately, network functions virtualization (NFV) rather than dedicated platforms,” said Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research. “This is a long-term shift that will keep video revenue from growing more significantly, despite the fact that pay-TV providers must fundamentally alter their video processing environments to support linear, over-the-top (OTT) and multi-screen content that continues to grow exponentially.”

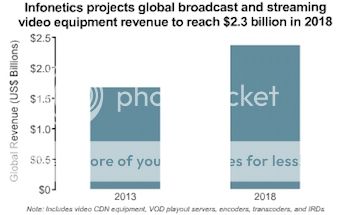

Despite the slow start in 2014, Infonetics expects streaming video and broadcast equipment revenue for the full-year to be up slightly. Infonetics projected that global broadcast and streaming video equipment revenue would reach $2.3 billion by 2018.

Also in the first half of 2014, sales of VOD playout servers rose 20 percent from 2H13 as operators in China and the Middle East continued to drive spending.

Content delivery network (CDN) edge server revenue was forecast by Infonetics to grow at a 14 percent CAGR from 2013 to 2018 while multi-screen broadcast encoders were expected to grow moderately.