Sensors marketing consultant Roger Grace has issued his 2021 MEMS Commercialization Report Card. Do you agree with his conclusions?

The report card, that dreaded moment when you received your school grades conjures up memories of how to tell your parents that your grades were below expectations. The same happens when sensors marketing consultant Roger Grace issues his 2021 MEMS Industry Commercialization Report Card. Grace has given an overall grade of C+ for 2021. (Don’t let the “A+” graphic on the registration page fool you.) To find out why, I spoke with Grace using computer audio.

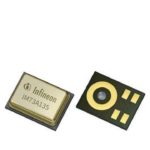

MEMS sensors include inertial, pressure, microphone, environmental, and optical sensors together form a $14B market, according to Grace.

In the 2021 report card, Grace sites on page 6 several reasons that limit MEMs commercialization, which include a lack of well-defined roadmaps, packaging and testing costs, and a lack of focus on customer needs. In our conversation, Grace also pointed to a lack of industry standards. He noted that “SEMI has done an incredible job creating over 1000 standards for the semiconductor industry while the MEMS community has created about ten. Standards are important to bring an industry together.” As a result, Grace has never given standards a grade higher than B-, with the 2022 grade being a C-.

Why such a low grade? Grace points to the way the MEMS industry started. “Everyone went their own way,” he said. “Nobody wanted to share their information. We don’t have standards for measuring parameters such as linearity.”

Industries such as test and measurement, semiconductors, and communications rely heavily on standards. Without measurement standards, for example, you’d have no idea what you’re buying. Imagine a world without communications standards. Equipment and networks would likely never talk to each other. The entire industry benefits. What would it take to get the MEMS industry to adopt standards that can benefit engineers designing systems with those sensors?

“We need some electro-shock therapy,” said Grace. Without it, MEMS remains a fragmented market with many small players and a few large players, as Grace noted in the report. Grace noted that a few large companies such as Analog Devices, STMicroelectronics, NXP, and Bosch make up about 75% of the market, but there are many small, independent companies but people don’t want to share information.” Grace cites a certain “paranoia” among MEMS manufacturers. He cited a case that did result in a standard, though it’s not specific to MEMS: IEEE 1451, a standard for protocols of smart sensors, which that grew out of NIST. “People at these small companies don’t see the value in developing standard because doing so take away valuable time and resources. I don’t see that changing.” Grace said this spite of the fact that the MEMS and Sensors Industry Group (MSIG) is now part of SEMI and it has three working groups: a Device Working Group, Manufacturing Group, and a Reliability Working Group. Grace gave his opinion while at the same time praising SEMI for its standard work on semiconductor standards. Grace sees this as an opportunity for SEMI to develop standards but so far, that’s not happened. According to Grace, SEMI-MSIG has developed a standard of definitions, but that’s all. “I’ve recommended that MSIG members look at the SEMI standards and see which can apply to MEMS. Look for the low-hanging fruit and modify close standards. Create MEMs standards. Nobody ever adopted that.”

In his report, Grace mentions “Lack of focus on customer needs.” When asked about that, Grace pointed to a need for more and better marketing, saying that the large players in the market do sufficient marketing, but not the small companies. Too many companies don’t do the vetting of the market to see what products are needed and what kind of specifications and features they should have. The effort goes into the $400B semiconductor business rather than the $14B MEMS business, even though MEMS was developed just five years after the first transistor. It’s the ‘little brother’ effect.”

Roger’s recommendations

Pages 27 and 28 of Grace’s report card makes several suggestions. Do you agree?

- Adopt new media strategies including social media, webinars, email to keep/develop new customers…lessons learned from COVID-19.

- Embrace system solutions/integrated products vs. component approach to maximize value and encourage investments.

- Define and establish defensible product differentiation.

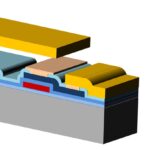

- Continue to develop manufacturing / packaging solutions that can help differentiate the product from a price/feature/performance perspective…packaging and testing will continue to be “king.”