By Leonie Clayson, DesignSpark Community Manager, RS Components

After many years of expectation, 5G has arrived. In the USA, both Verizon and AT&T launched targeted services at the end of 2018, closely followed by the three major operators in South Korea. In the rest of the world, launch plans vary between 2019 and 2020, but there is no doubt that 2019 will be the year when 5G moves from network trials to commercial reality.

Two key milestones this year will further underline 5G’s progress — in December, 3GPP, the organization tasked by the International Telecommunications Union (ITU) with developing the 5G technical specifications, is scheduled to deliver Release 16, thereby completing the work, in-line with the ITU’s 2020 target. Also, in October, the ITU’s World Radio Conference will hold its four-yearly meeting (WRC-19) at which the global spectrum allocations for 5G will be agreed upon.

This article takes a closer look at 5G, what it is, why the excitement and what we can expect to see over the coming years.

What is 5G?

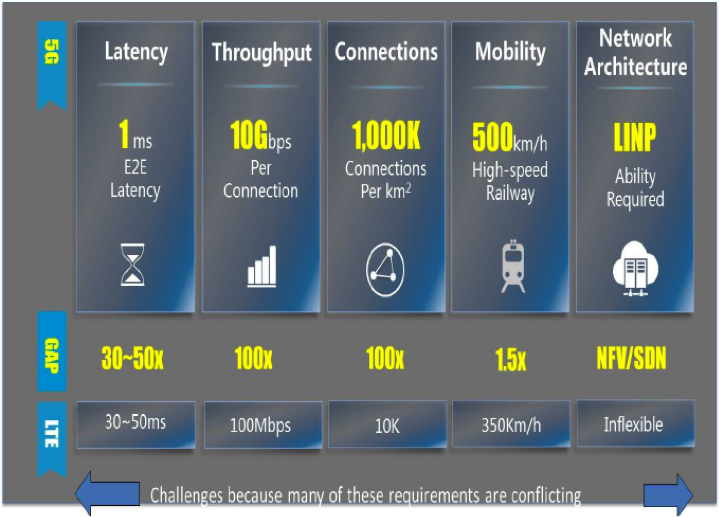

The world’s hunger for bandwidth is insatiable and continues to grow exponentially, driven by the IoT and emerging applications such as autonomous vehicles and AI. Current 4G/LTE wireless technology will be unable to support this growth for much longer and, recognizing this, in 2010 the ITU defined the vision for the next generation of mobile networks, 5G. The specification, contained in ITU document IMT-2020, summarized in Figure 1 below, includes a number of challenging objectives, including throughputs of up to 10 Gbps (100 times faster than 4G networks), latencies of 1 mSec, (c.f. 30 – 50 mSec for 4G) and connection densities of 1000 devices per square kilometre, (100 times more than 4G).

To meet these challenges, designers have adopted a completely new network architecture, utilizing several advanced technologies, including:

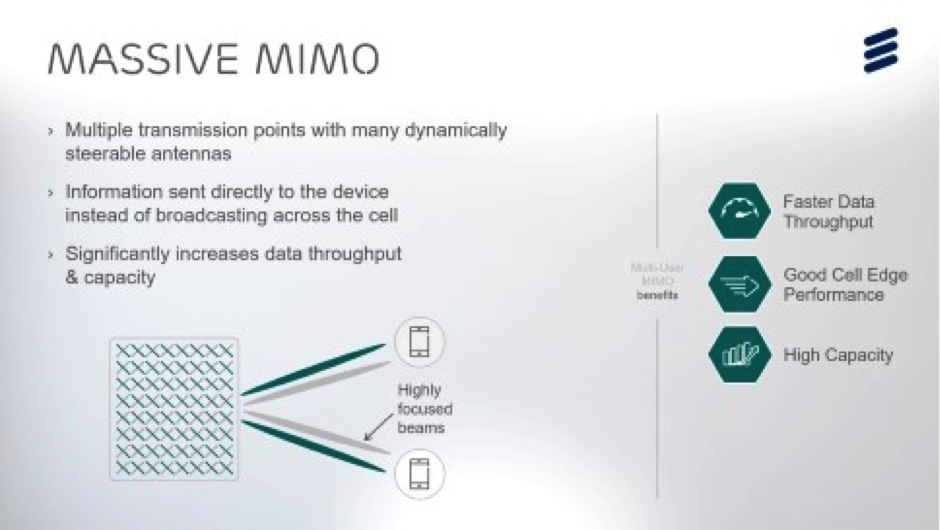

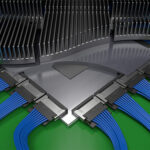

- Massive Multiple Input Multiple Output, (MIMO) and beamforming (Figure 2). Massive MIMO significantly increases network capacity and coverage by deploying hundreds of large antenna arrays in base stations, enabling multiple users to utilize the same time and frequency resources simultaneously. Beamforming works within the Massive MIMO antenna array to increase the capacity and effectiveness of radio transmissions by shaping the radio signals into highly focused, steerable beams, delivering a stronger radio signal over a greater distance while using less energy.

- Radio spectrum is key to the speeds and latencies required for 5G and, although 5G spectrum allocations won’t be finalized until WRC-19, a framework has already emerged around which many countries have begun to hold auctions:

- Sub 1GHz — the ‘coverage layer’, providing wide area and deep indoor coverage

- 1GHz-6GHz – ‘coverage and capacity layer’, uses C-band spectrum around the 3.5GHz mark to deliver the best compromise between capacity and coverage

- Above 6GHz – the ‘super data layer’, uses higher frequency millimeter-wave (mmWave) spectrum to deliver high data rates for specific use cases. This band will be the key enabler of future 5G services

- Network slicing is another key 5G architectural component, using the principles behind software-defined networking, (SDN), and network functions virtualization, (NFV), to create multiple virtual networks on top of a common shared physical infrastructure. These virtual networks are then customized to meet the specific needs of applications, services, devices, customers or operators.

- Mobile edge or Multi-access Edge Computing, (MEC), enables cloud computing to be done at the edge of a mobile network by integrating functionality into local cellular base stations. By bringing online computations and content storage closer to the end devices, 5G will be able to manage network traffic loading more intelligently, and MEC will also be a key technology in reducing 5G network latencies.

“Hot” applications

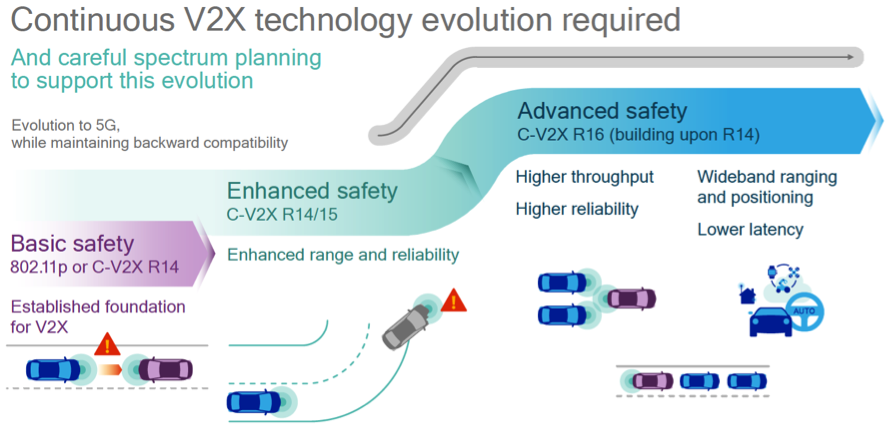

The capabilities of 5G promise to unlock latent demand within a growing number of applications across a range of verticals. In the automotive sector, C-V2X (cellular vehicle to everything), technology will connect everything on the roads, including vehicles, traffic lights, gantries, lampposts and also the roads themselves. Data on the road conditions, traffic levels, environmental conditions, etc. will be collected and exchanged between sensors, and the technology requires the speeds and latencies of 5G to be viable — particularly as human lives will be at stake. The 3GPP specifications have evolved to support various generations of V2X technology, (Figure 3), and the delivery of Release 16 will be key to the vision of fully autonomous vehicles.

In the industrial sector, the demands of volatile global markets are driving manufacturers to adopt the Industry 4.0 smart factory model, based on flexible, modular and versatile production techniques, combining human expertise with automation, including cyber-systems. Existing hard-wired networks cannot support smart factory requirements while the latency of current wireless networks makes them unsuitable for many real-time process automation applications. 5G promises to remove the networking constraints, and Figure 4 illustrates how the top smart factory use cases map to the 5G service requirements defined in the ITU specification.

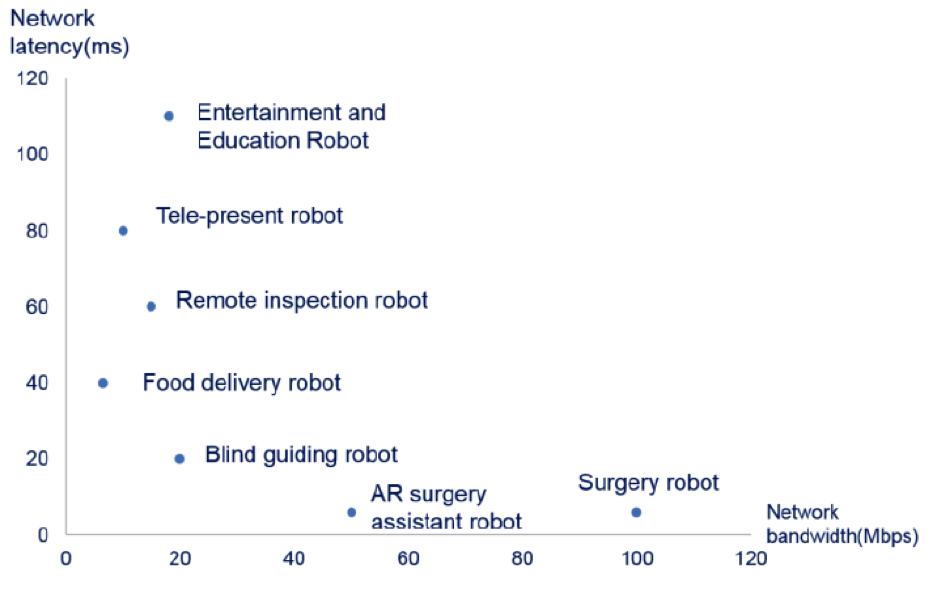

Widely used in industry, robots are also finding applications in areas such as healthcare, logistics, guidance, security and surveillance, education and entertainment. Advances in artificial intelligence (AI) are increasing their capabilities, and the emergence of cloud robots brings some advantages, including information sharing, off-loaded computation, and enhanced collaboration.

Until now, however, network performance has been a barrier to cloud robotics, both in terms of the amount of data that can be carried and the latency. “Seamless” robot response capabilities require that video capture, video coding, network transmission, cloud decoding, and visual AI be achieved within a delay of 100 mSec, requiring 5G levels of latency. Figure 5 illustrates the network capabilities for various robotic applications.

Deployment considerations

While offering significant opportunities to network operators, 5G deployment also poses several challenges. Many operators are still rolling out 4G networks and, in many cases, have yet to see returns on these 4G investments. Full-scale 5G roll-outs will demand even more capital expenditure — on infrastructure and spectrum — and operators must be careful to monetize these investments.

In recognition of this, 3GPP’s initial work focussed on developing specifications for 5G non-stand-alone (NSA) technology, which enables certain elements of 5G to be rolled out as an evolution of 4G/LTE networks, enabling operators to leverage existing investments. Low to mid-band 5G networks can be evolved from 4G/LTE by re-farming 2G/3G spectrum and then upgrading existing infrastructure with massive MIMO. Such a strategy would enable an operator to launch services based on low-band 5G, generating new revenue streams while delaying development of the high-cost high band infrastructure, where much denser networks are required.

A review of roll-out plans in the major markets of China, Japan, and Europe shows that many operators seem to be following this strategy, including Japan’s KDDI and Softbank, as well as EE and Vodafone in the UK, whose initial 5G plans are based on spectrum in the 3.5 – 4.5 GHz bands.

Conclusion

2019 will be a pivotal year for 5G as operators begin to launch service, marking the start of a five-year period during which 5G global coverage is forecast to reach 40 percent. With operator revenues set to grow at a CAGR of 2.5 percent to reach $1.3 trillion by the end of the same period, and ICT players in the manufacturing vertical alone expected to generate 234 billion USD of 5G revenues, the opportunities unlocked by 5G will be significant.

5G has long promised to transform our working and home lives, and 2019 is set to be the year when the technology begins to deliver against this promise.

Leave a Reply

You must be logged in to post a comment.