Understanding the past, present, and future of semiconductor manufacturing and what it means for the components that make it work.

By Lawrence Crynes, Ph.D., Market Manager, Semiconductor, Swagelok Company

Moore’s Law predicted that the number of transistors on an integrated circuit (or microchip) will need to double every two years while the cost of computing would be reduced by as much as half, leading to exponential growth in computing power. The semiconductor industry has worked hard to keep up with this paradigm, but constantly providing more processing power in less space is no small feat. This article will assess what challenges the semiconductor industry is facing and what the future may hold for the components that make the industry work.

What drives innovation?

Several important factors have driven the evolution of the semiconductor industry over the years, ranging from the space program to everyday consumer technology. Today, much of the industry’s innovation centers on the development of artificial intelligence (AI) and the push toward autonomous vehicles.

What each of these drivers has in common is an overwhelming push to produce ever-smaller microchips more quickly to keep up with Moore’s Law, a process called miniaturization. To accommodate the manufacturing advancements necessary to produce the smaller chips, production equipment must also evolve.

OEMs receive constant feedback from semiconductor fabricators to understand their evolving needs, ensure they are meeting the most recent chip performance standards, and provide design production equipment that will help fabricators achieve their goals.

The question of what drives semiconductor innovation is dependent on different variables. In some cases, there is a generalized impetus to evolve semiconductor technology overall that leads to breakthroughs, while other improvements are driven by the need to improve performance of existing applications.

What role do fluid systems play?

The ongoing demand for smaller, more powerful chips has led to a revolution in fluid system componentry. As transistors become smaller, it is increasingly important to prevent contamination in the process because it can have an impact on yields and chip reliability.

This need to avoid contamination has led to a shift from diaphragm valves back to bellows valves. Diaphragm valves had initially replaced bellows valves because they were cleaner and had fewer moving parts. But the benefits of bellows valves’ high-flow capacity, while keeping the ultrahigh-purity (UHP) performance, have allowed more sophisticated bellows valves to return to the semiconductor industry without sacrificing the cleanliness so essential to the manufacturing process.

Tool OEMs realized disappointing chip yields were often caused by process issues instead of faulty fluid system equipment and focused primarily on removing those from the equation. While this has improved chip yields for the manufacturers, it has also required an upgrade of the standards for advanced fluid system components and system designs. Component manufacturers are still adjusting to this new reality.

How do today’s challenges affect fluid system components?

The challenges facing the semiconductor industry are matters of consistency and quality at higher temperatures and flow rates. As a result, fluid system component manufacturers must also improve on these measures – because semiconductor production equipment needs UHP valves that are high quality individually but that also maintain quality valve to valve.

As tolerances grow ever tighter, there is less margin for error – meaning valve manufacturers must tighten quality control measures throughout the entire production process. Cleanliness and corrosion resistance are critical, and manufacturers that employ excellent materials science experts have an advantage over those that do not.

Fluid system solutions providers should consult with OEMs and semiconductor manufacturers as new products are brought to market. Those collaborations are central to making sure new fluid system components meet the needs and development timelines of their intended markets.

What does the future hold?

As materials evolve and the industry looks to increase production, fluid systems must also evolve. New technology, like selective deposition-enabling technology, will allow semiconductor manufacturers to be even more precise about what they deposit on a wafer. To accommodate that, fluid systems will have to become even more precise as well.

In addition, the age of silicon wafers may soon be coming to an end. Silicon carbide is increasingly an option for semiconductor manufacturers. Other materials like germanium could also return to use because silicon no longer meets the needs of providing power to minuscule transistors. Other specialty materials exist as well, but they have not yet been made economically enough to promote their widespread use.

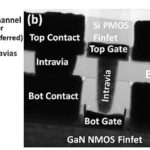

It is not just wafer materials that will need to change. The processes, including what is deposited, how etching is done, and other processes, will need to evolve as well. Even newer methods like extreme ultraviolet lithography, which seem revolutionary at the moment, may not work as transistor sizes go below 5 to 3 nanometers.

The smaller the microchip, the higher the cost to produce them. As a result, Moore’s Law may no longer be applicable to the broader industry but may instead become the rule for specialty providers.

The pace of transition in the semiconductor industry shows no signs of slowing down and fluid system manufacturers must work tirelessly to keep up.

About the author

Lawrence Crynes, Ph.D., is Market Manager, Semiconductor for Swagelok Company.

Lawrence Crynes, Ph.D., is Market Manager, Semiconductor for Swagelok Company.

Leave a Reply

You must be logged in to post a comment.